All about financial planning

Retirement-Focused Case Study

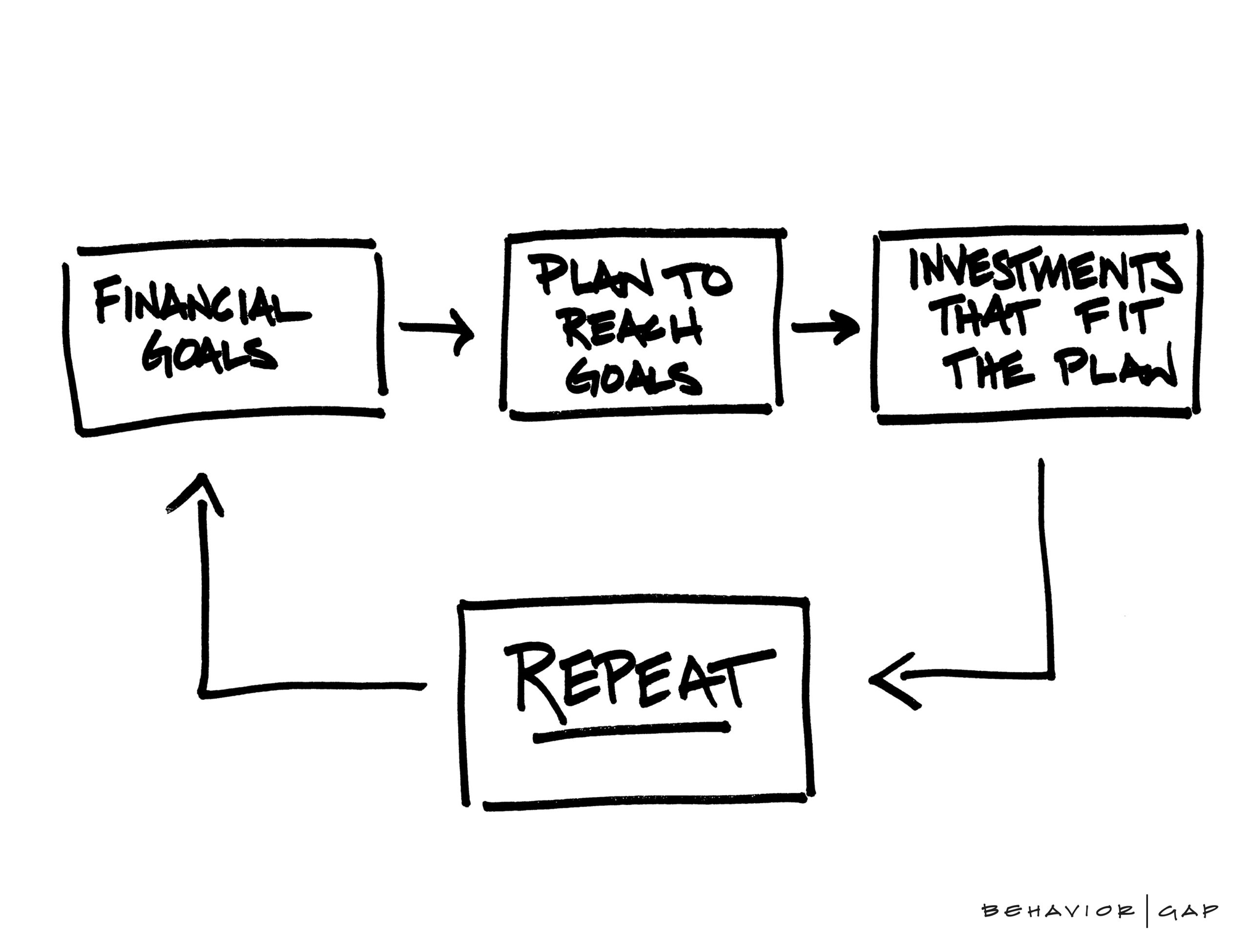

“Financial Planning” is not a descriptive term. What, exactly, does it mean?

Hopefully this case study will help illustrate that a financial plan is more than goals-based investment management. Planning is also more than just a plan. Planning involves regularly reviewing the plan and making changes as circumstances change.

While this is common and even actual advice given, it’s just a hypothetical scenario. This case study should not be relied upon or interpreted as specific advice and you should consult your financial, tax or legal professional about your specific situation.

Or schedule an intro call to discuss how this may apply to you.

Background

Let’s imagine a couple in their 60s. They’re the stereotypical Millionaire Next Door. They saved the old-fashioned way through hard work and sacrifice. Their children have completed college and started families of their own. In fact, one of their primary desires in retirement is to spend time with their grandchildren. They own a house and, since they are fans of Dave Ramsey’s Financial Peace, they do not have any debt.

Tax Strategies

- Since their taxable income dropped significantly once retired, they were able to do small Roth conversions at a lower tax rate before taking Social Security and Required Minimum Distributions kicked in.

- They were also able to realize some capital gains at the 0% tax rate.

- They were able to get their parents to start doing Qualified Charitable Distributions so they got the tax benefit of donations since they are over 70.5 years of age.

- They set up a Donor Advised Fund to get a tax benefit for their giving.

- Since they wanted to help fund their grandkids’ college, they were going to open 529 plans. Instead, they gifted the money to their kids (the parents) who then contributed, getting more benefit from the state tax deduction.

Estate Planning

- Since their Will is a couple of decades old, they worked with an attorney to update their estate documents.

- They also included trust provisions since one of their grandkids has special needs and their oldest daughter is a doctor with significant liability issues.

- They’re considering a second home beach house and will look into a revocable trust to avoid probate.

- After reviewing their beneficiary designations, we made some changes because of the new SECURE Act.

Retirement Planning

- Beyond their lifestyle, we identified their goals of taking an annual trip abroad for them, and paying to have all the kids and grandkids for a week at the beach each year.

- She went ahead and took her Social Security because half of his would be more, allowing her to get higher spousal benefits later. He is waiting until 70 because the higher benefit will remain for the survivor and they are both in good health.

- We identified the starting amount to take out of their portfolio to maintain their standard of living, while minimizing “sequence of returns” risk. The amount could go up if the market is favorable.

- Since their old annuity didn’t have any special benefits, we were able to do a “1035 Exchange” into a better annuity with no commissions or surrender charges and without any tax consequences.

Insurance

- Since nobody depends on them financially anymore and they were financially independent, they decided they didn’t need life insurance anymore.

- They decided against Long-Term Care insurance, but came up with a plan to use their home equity to fund long-term care. They are also going to consider a Continuing Care Retirement Community when they get older.

- Their auto insurance coverage was okay, but expensive. By quoting other carriers and raising their deductible, they were able to increase their coverage and lower their premiums.

- He had given her some nice jewelry over the years and she had inherited some. This was not covered under their homeowners policy until they added an endorsement.

- They were also able to get an additional $1mm umbrella liability coverage.

Government Benefits

- In addition to Medicare Parts A and B, they signed up for Medicare Part D using the online formulary to identify the best plan. They also signed up for a Medigap Plan.

- We made sure to avoid IRMMA Medicare surcharges when taking the capital gains and doing the Roth conversions.

Investment

- While they had a reasonable asset allocation, they were invested in high-fee and tax-inefficient mutual funds. We matched the overall allocation with their anticipated spending, using “buckets” of cash and high quality bond funds as a shock absorber to limit the impact of volatility in the shorter term spending, with their longer term money invested in stocks for growth potential and maintaining standard of living.

- Even with PFP’s fee, they were able to pay about the same cost to start working with a Fiduciary advisor who also helped them with these other non-investment areas of personal finance.

- Their rainy day fund was in a brick and mortar bank, so we were able to increase their rate just by using an online savings account.

Questions about how this may apply to you?

Our Role:

You’re the main character, with desires (maintain standard of living), aspirations (that special trip you’ve been putting off), obstacles (conflicting information on Google) and even villains (dishonest financial sales reps).

We’re just the guide. Like any good guide, we’ll help point out blind spots and help you think through important decisions. Since we’ve helped others to and through retirement, we can help you be proactive rather than reactive. We’ll also help you adjust along the way, whether through life’s transitions, economic shocks (COVID-19…) or regulatory change (tax reform, SECURE Act, CARES Act…).

As a Fee-Only Fiduciary, we are only compensated by our clients (no product sales) and are legally required to act as a Fiduciary at all times.